In this day and age when screens dominate our lives and the appeal of physical printed items hasn't gone away. In the case of educational materials or creative projects, or simply adding an individual touch to the area, What Is The Non Taxable Part Of Social Security are a great resource. With this guide, you'll dive into the sphere of "What Is The Non Taxable Part Of Social Security," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest What Is The Non Taxable Part Of Social Security Below

What Is The Non Taxable Part Of Social Security

What Is The Non Taxable Part Of Social Security -

Updated June 11 2021 Yes The rules for taxing benefits do not change as a person gets older Whether or not your Social Security payments are taxed is

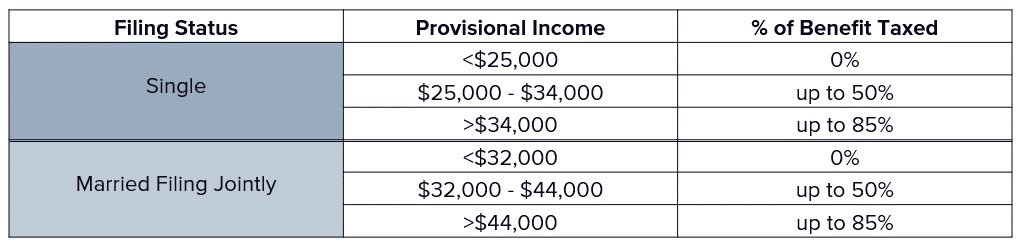

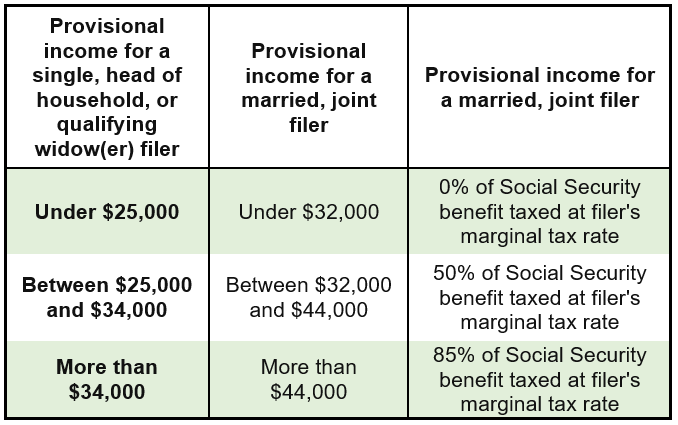

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your

What Is The Non Taxable Part Of Social Security offer a wide range of printable, free items that are available online at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The benefit of What Is The Non Taxable Part Of Social Security is in their versatility and accessibility.

More of What Is The Non Taxable Part Of Social Security

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

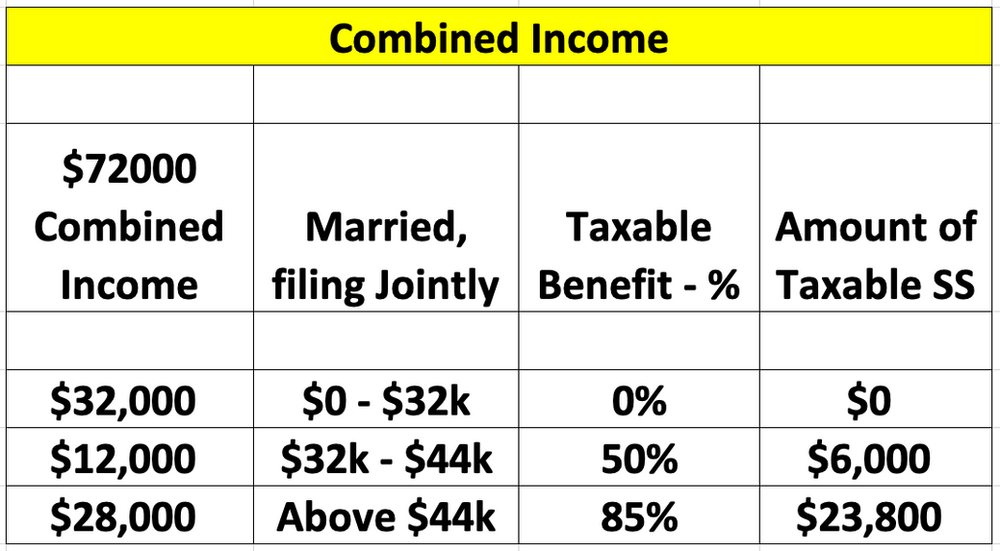

Up to 85 of Social Security benefits are taxable for an individual with a combined gross income of at least 34 000 or a couple filing jointly with a combined

Up to 85 of your Social Security benefits may be subject to taxes at your ordinary income tax rate but 44 of people won t owe any income taxes on their Social

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: It is possible to tailor printed materials to meet your requirements when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them a useful tool for teachers and parents.

-

Accessibility: instant access a variety of designs and templates saves time and effort.

Where to Find more What Is The Non Taxable Part Of Social Security

What Is The Taxable Amount On Your Social Security Benefits

What Is The Taxable Amount On Your Social Security Benefits

If your combined income is under 25 000 single or 32 000 joint filing there is no tax on your Social Security benefits For combined income between

You nontaxable interest Half the amount of your Social Security benefit This total is your combined income If your combined income is more than 34 000 for singles or 44 000 for couples up to

Now that we've piqued your curiosity about What Is The Non Taxable Part Of Social Security Let's look into where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of What Is The Non Taxable Part Of Social Security for various reasons.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, including DIY projects to party planning.

Maximizing What Is The Non Taxable Part Of Social Security

Here are some ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

What Is The Non Taxable Part Of Social Security are a treasure trove of practical and innovative resources that meet a variety of needs and hobbies. Their access and versatility makes them an essential part of each day life. Explore the vast array of What Is The Non Taxable Part Of Social Security today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is The Non Taxable Part Of Social Security really gratis?

- Yes they are! You can print and download these materials for free.

-

Can I make use of free printables for commercial use?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with What Is The Non Taxable Part Of Social Security?

- Some printables may come with restrictions regarding usage. You should read the terms and conditions offered by the creator.

-

How do I print What Is The Non Taxable Part Of Social Security?

- Print them at home with an printer, or go to a local print shop for the highest quality prints.

-

What program is required to open printables for free?

- Many printables are offered in PDF format. These can be opened using free software such as Adobe Reader.

Is Social Security Taxable YouTube

Foreign Social Security Taxable In Us TaxableSocialSecurity

Check more sample of What Is The Non Taxable Part Of Social Security below

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

12 Non Taxable Compensation Of Government Employees 12 Non taxable

What Is Taxable Income Explanation Importance Calculation Bizness

20 Social Security Benefits Worksheet 2019 Worksheets Decoomo

Resource Taxable Social Security Calculator

56 Of Social Security Households Pay Tax On Their Benefits Will You

https://smartasset.com/retirement/is-social...

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your

https://www-origin.ssa.gov/benefits/retirement/planner/taxes.html#!

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married

20 Social Security Benefits Worksheet 2019 Worksheets Decoomo

12 Non Taxable Compensation Of Government Employees 12 Non taxable

Resource Taxable Social Security Calculator

56 Of Social Security Households Pay Tax On Their Benefits Will You

Are My Social Security Benefits Taxable Calculator

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

What Is Rate Of Social Security Tax And Medicare Tax