In this age of technology, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or simply adding an individual touch to your space, What Is A 1120 S Tax Form have become a valuable source. Here, we'll take a dive into the sphere of "What Is A 1120 S Tax Form," exploring what they are, where they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest What Is A 1120 S Tax Form Below

What Is A 1120 S Tax Form

What Is A 1120 S Tax Form -

IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow through to shareholders An S corporation is a pass through tax entity

Form 1120 S is the annual tax return for businesses that are registered as S corporations The form is used to report income gains losses credits deductions and other information for

The What Is A 1120 S Tax Form are a huge assortment of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and much more. The beauty of What Is A 1120 S Tax Form lies in their versatility as well as accessibility.

More of What Is A 1120 S Tax Form

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses 2023

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses 2023

The IRS Form 1120 S is a tax document that you will use to furnish financial information to the Internal Revenue Service You ll need the 1120 S form to report your company s yearly financial activity including your business s gains losses credits and dividends In other words your S corporation s annual corporate tax return is Form 1120 S

IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax year It s used to determine an S corporation s business income gains losses tax credits and deductions Who should fill out the 1120 S Tax Form

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize printed materials to meet your requirements when it comes to designing invitations and schedules, or even decorating your home.

-

Educational Value The free educational worksheets are designed to appeal to students of all ages, making them a valuable tool for parents and teachers.

-

The convenience of immediate access a variety of designs and templates cuts down on time and efforts.

Where to Find more What Is A 1120 S Tax Form

A Beginner s Guide To S Corporation Taxes

A Beginner s Guide To S Corporation Taxes

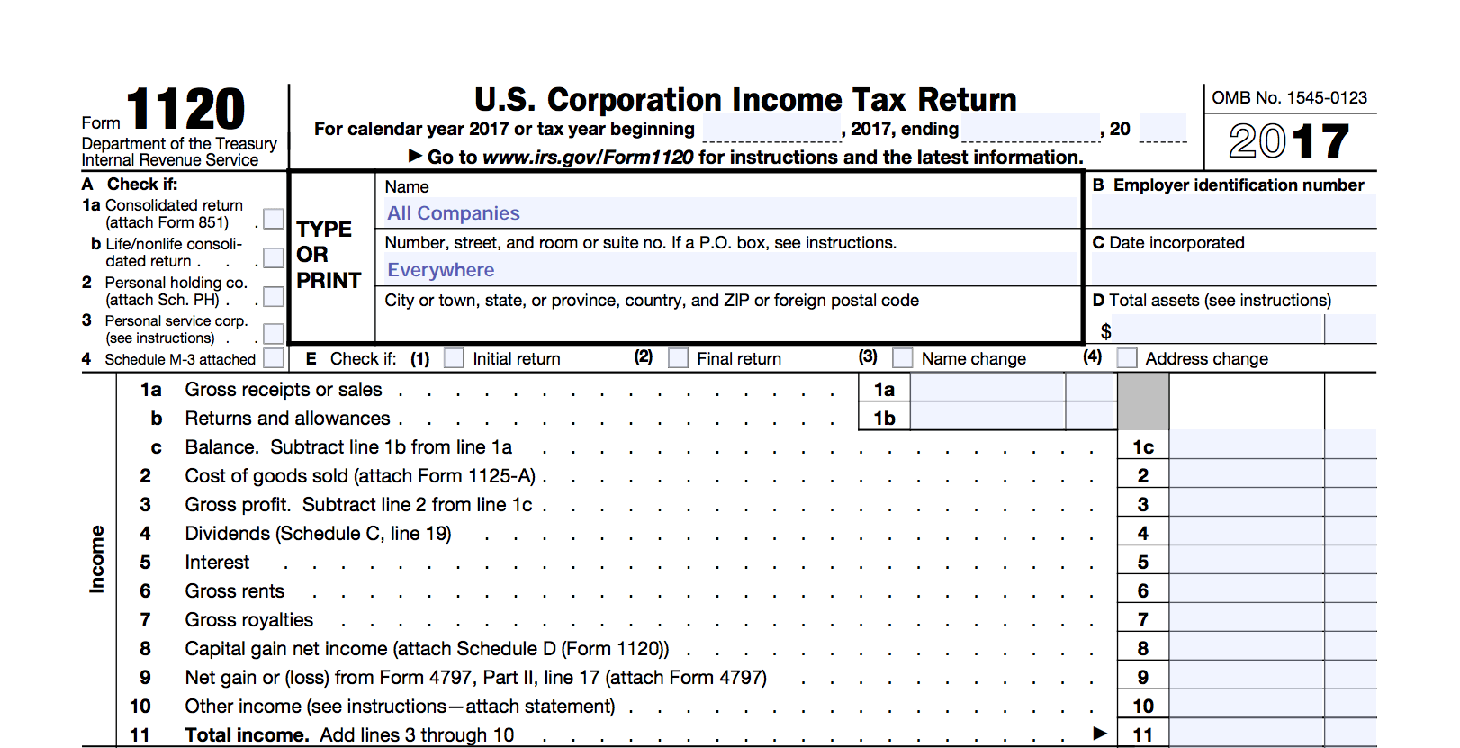

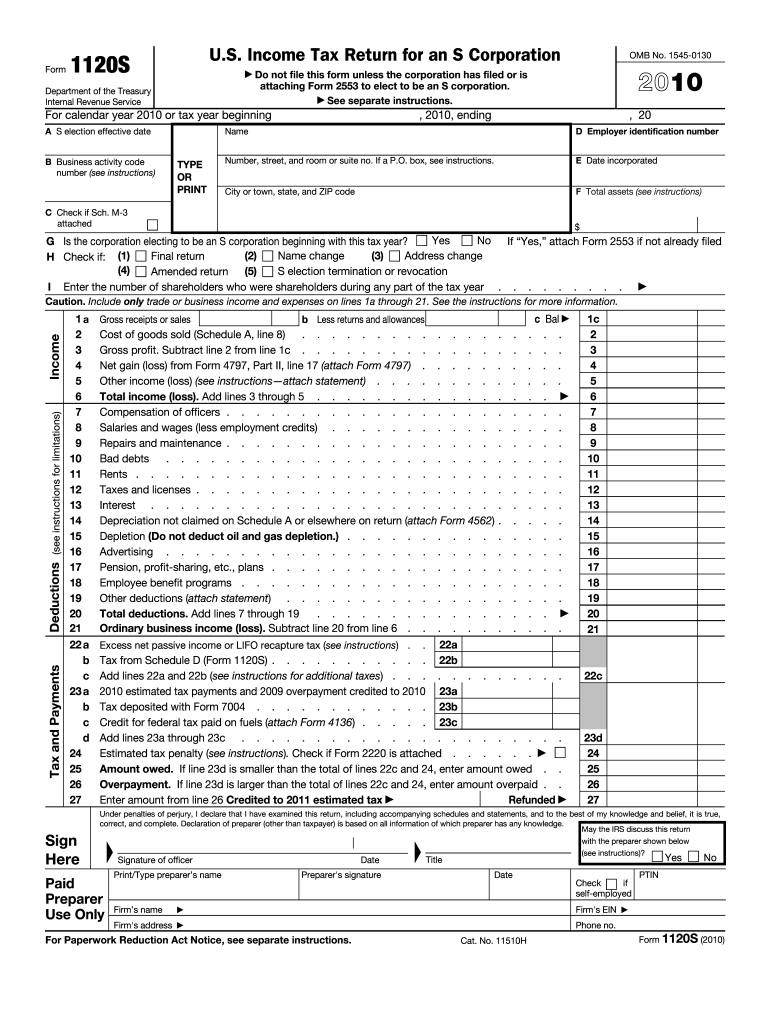

IRS Form 1120 S officially called the U S Income Tax Return for S Corporation may sound like a mouthful but it is an essential income tax form for many S corporation entrepreneurs This form is used to report annual income losses deductions credits and other transactions

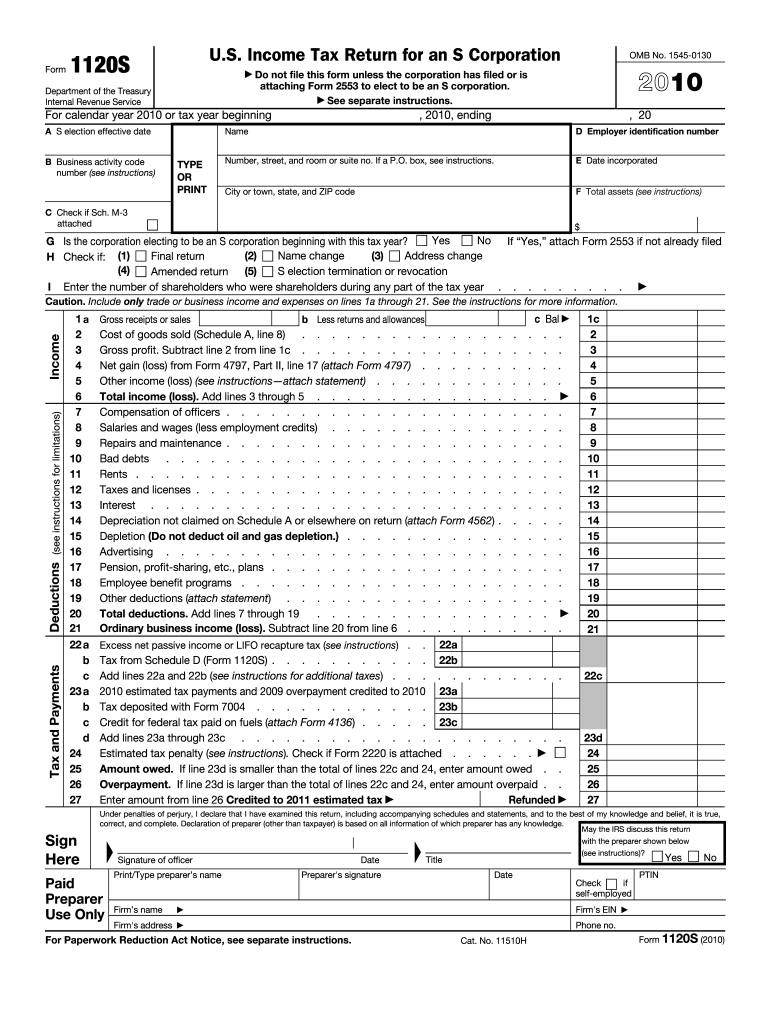

Form 1120 S Department of the Treasury Internal Revenue Service U S Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation Go to www irs gov Form1120S for instructions and the latest information OMB No 1545 0123

If we've already piqued your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and What Is A 1120 S Tax Form for a variety uses.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing What Is A 1120 S Tax Form

Here are some ideas to make the most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is A 1120 S Tax Form are an abundance of creative and practical resources that satisfy a wide range of requirements and needs and. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast collection that is What Is A 1120 S Tax Form today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes they are! You can print and download these resources at no cost.

-

Are there any free printables in commercial projects?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with What Is A 1120 S Tax Form?

- Some printables may contain restrictions in their usage. Check the terms and regulations provided by the designer.

-

How can I print What Is A 1120 S Tax Form?

- You can print them at home with a printer or visit a print shop in your area for high-quality prints.

-

What software do I need to run printables that are free?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software such as Adobe Reader.

Who Should Use IRS Form 1120 W

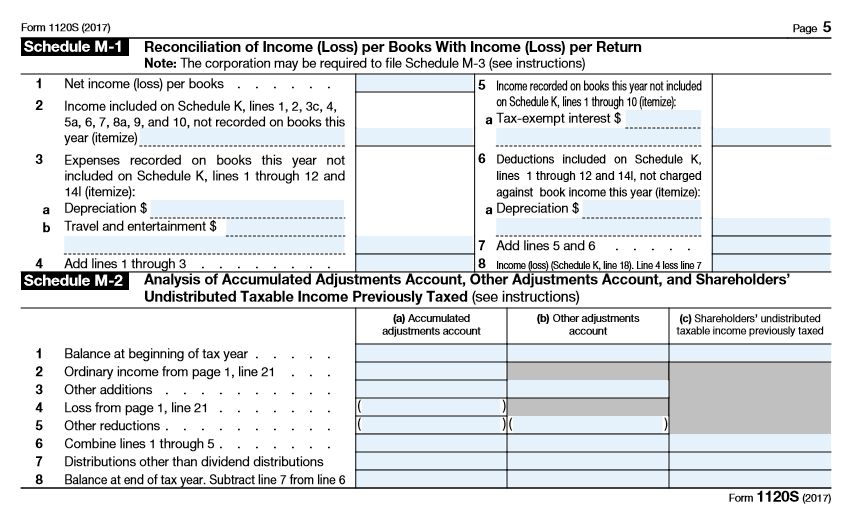

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

Check more sample of What Is A 1120 S Tax Form below

Schedule K 1 Form 1120 S Shareholder s Share Of Income Overview

2010 Form IRS 1120S Fill Online Printable Fillable Blank PdfFiller

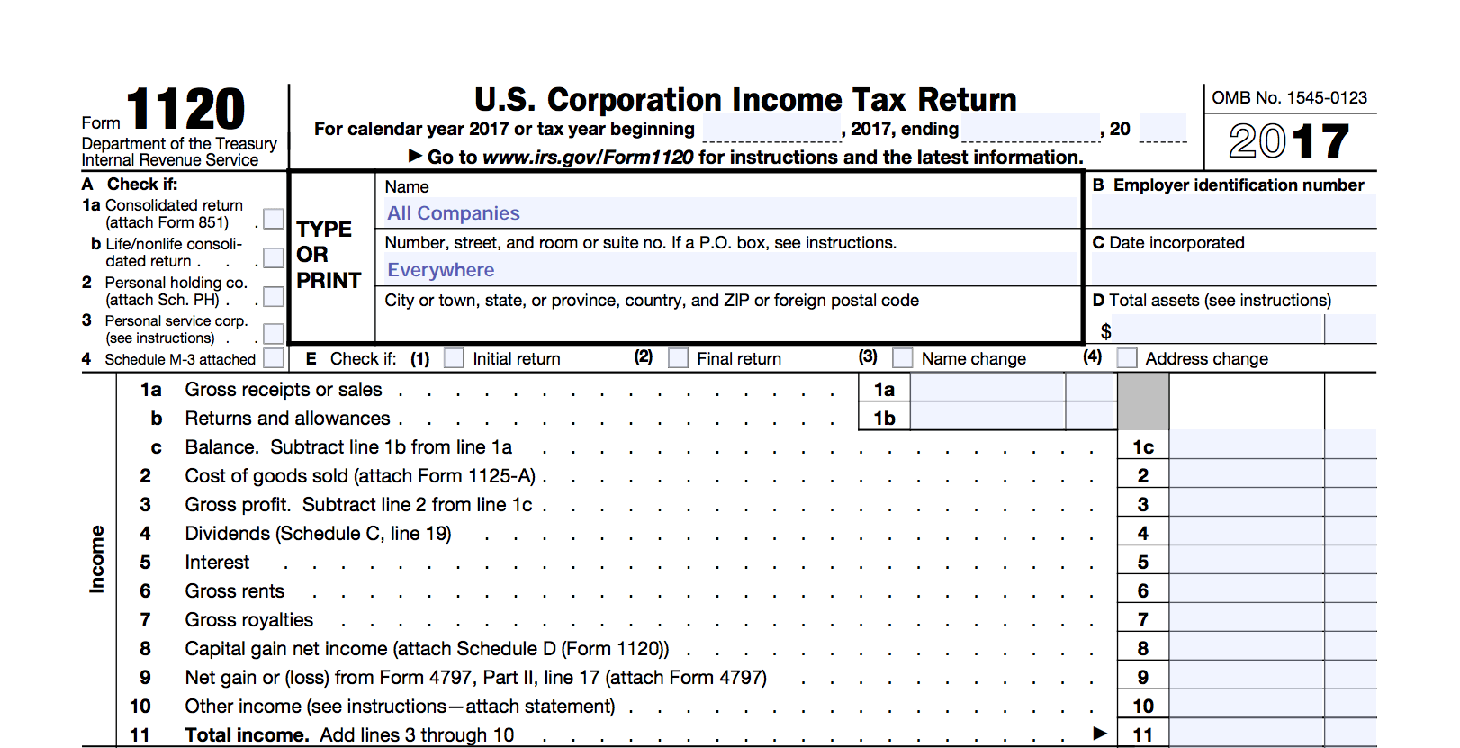

Learn How To Fill The Form 1120 U S Corporation Income Tax Return

Do I Need To File A Form 1120 If The Business Had No Income

Irs Form 1120 Excel Template Budget For Business Excel Template

1120s Due Date

https://www.investopedia.com/terms/f/form-1120s.asp

Form 1120 S is the annual tax return for businesses that are registered as S corporations The form is used to report income gains losses credits deductions and other information for

https://www.irs.gov/instructions/i1120s

For 2023 a corporation that a is required to file Schedule M 3 Form 1120 S Net Income Loss Reconciliation for S Corporations With Total Assets of 10 Million or More and has less than 50 million total assets at the end of the tax year or b isn t required to file Schedule M 3 Form 1120 S and voluntarily files Schedule M 3 Form

Form 1120 S is the annual tax return for businesses that are registered as S corporations The form is used to report income gains losses credits deductions and other information for

For 2023 a corporation that a is required to file Schedule M 3 Form 1120 S Net Income Loss Reconciliation for S Corporations With Total Assets of 10 Million or More and has less than 50 million total assets at the end of the tax year or b isn t required to file Schedule M 3 Form 1120 S and voluntarily files Schedule M 3 Form

Do I Need To File A Form 1120 If The Business Had No Income

2010 Form IRS 1120S Fill Online Printable Fillable Blank PdfFiller

Irs Form 1120 Excel Template Budget For Business Excel Template

1120s Due Date

What Is Form 1120S And How Do I File It Ask Gusto

How To File Form 1120 S U S Income Tax Return For An S Corporation

How To File Form 1120 S U S Income Tax Return For An S Corporation

IRS Form 1120S Definition Download 1120S Instructions