Today, when screens dominate our lives, the charm of tangible printed material hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or just adding an individual touch to your space, What 12 States Don T Tax Social Security Or 401k Income are now a useful resource. We'll dive through the vast world of "What 12 States Don T Tax Social Security Or 401k Income," exploring what they are, how they are, and the ways that they can benefit different aspects of your life.

Get Latest What 12 States Don T Tax Social Security Or 401k Income Below

What 12 States Don T Tax Social Security Or 401k Income

What 12 States Don T Tax Social Security Or 401k Income -

Nine states have no income tax at all Four other states with income taxes don t tax Social Security IRA or 401 k distributions Even more states exempt at least some types of pension

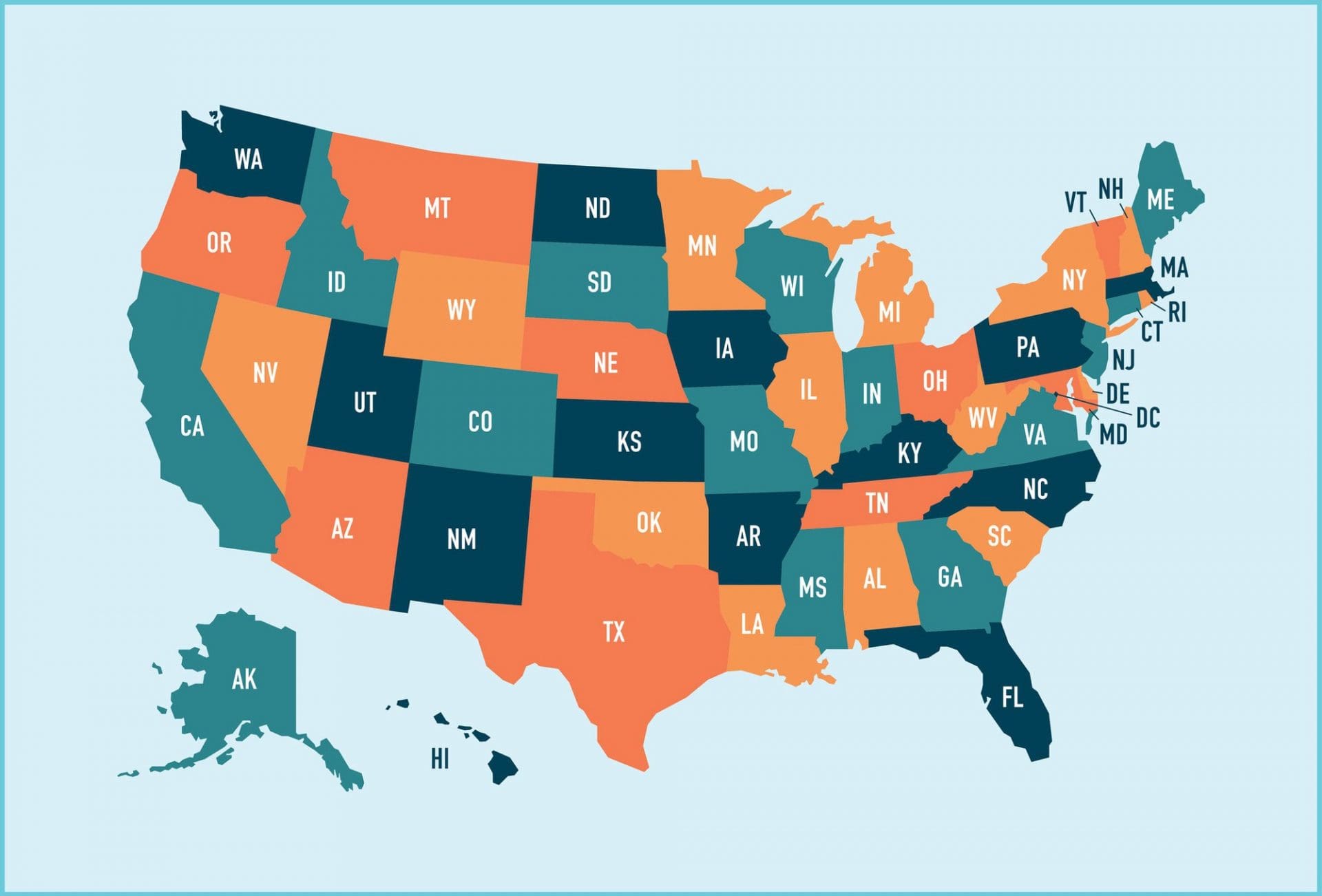

Most states don t tax Social Security benefits Nine states do to widely varying degrees Colorado Connecticut Minnesota Montana New Mexico Rhode Island Utah Vermont and West Virginia

Printables for free cover a broad assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and many more. The benefit of What 12 States Don T Tax Social Security Or 401k Income lies in their versatility as well as accessibility.

More of What 12 States Don T Tax Social Security Or 401k Income

Which States Don t Tax Social Security Benefits Market Trading

Which States Don t Tax Social Security Benefits Market Trading

Social Security would take the 20 400 add it to any other income you have and then tax it at your regular income tax rate If you re in the 22 tax bracket you d owe 4 488 on the 24 000 you

Most places tax retirees income from pensions and retirement accounts but 13 states do not This doesn t count Social Security which most states don t tax Retiring in a tax free state could

What 12 States Don T Tax Social Security Or 401k Income have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational Worth: Free educational printables can be used by students of all ages, which makes them a great aid for parents as well as educators.

-

It's easy: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more What 12 States Don T Tax Social Security Or 401k Income

Which States Don t Tax Social Security Benefits Stock Native

Which States Don t Tax Social Security Benefits Stock Native

The most tax friendly states for retirees are states that don t tax pensions and Social Security and have a low tax profile overall for sales and property tax Some of the best states for retirees who want to avoid high taxes include Alabama the District of Columbia Nevada and Tennessee

Nine states don t tax any income whether it s a paycheck or income from your 401 k IRA pension payments or Social Security check In addition four states with income tax make an

We've now piqued your curiosity about What 12 States Don T Tax Social Security Or 401k Income Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in What 12 States Don T Tax Social Security Or 401k Income for different applications.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning tools.

- The perfect resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing What 12 States Don T Tax Social Security Or 401k Income

Here are some ways create the maximum value of What 12 States Don T Tax Social Security Or 401k Income:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free for teaching at-home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What 12 States Don T Tax Social Security Or 401k Income are a treasure trove of practical and innovative resources that meet a variety of needs and interests. Their accessibility and flexibility make them a fantastic addition to the professional and personal lives of both. Explore the plethora of What 12 States Don T Tax Social Security Or 401k Income now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may have restrictions on usage. Be sure to read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with printing equipment or visit an in-store print shop to get more high-quality prints.

-

What program do I require to open printables at no cost?

- The majority are printed in the PDF format, and can be opened with free software such as Adobe Reader.

Which States Don t Tax Social Security Benefits National

37 States That Don t Tax Social Security Benefits

Check more sample of What 12 States Don T Tax Social Security Or 401k Income below

Social Security Benefit Taxes By State 13 States Might Tax Benefits

State by State Guide To Taxes On Retirees Flagel Huber Flagel

26 States That Won t Tax Your Social Security This Year Social

37 States That Don t Tax Social Security YouTube

These 38 States Don t Tax Your Social Security Benefits Legal

13 States That Tax Social Security Benefits

https://www.aarp.org/money/taxes/info-2023/states...

Most states don t tax Social Security benefits Nine states do to widely varying degrees Colorado Connecticut Minnesota Montana New Mexico Rhode Island Utah Vermont and West Virginia

https://www.forbes.com/sites/davidrae/2023/02/08/...

Distributions from your 401 k IRA or 403 b and even pension if you are lucky enough to still have one are considered income Depending on your total household income in retirement a

Most states don t tax Social Security benefits Nine states do to widely varying degrees Colorado Connecticut Minnesota Montana New Mexico Rhode Island Utah Vermont and West Virginia

Distributions from your 401 k IRA or 403 b and even pension if you are lucky enough to still have one are considered income Depending on your total household income in retirement a

37 States That Don t Tax Social Security YouTube

State by State Guide To Taxes On Retirees Flagel Huber Flagel

These 38 States Don t Tax Your Social Security Benefits Legal

13 States That Tax Social Security Benefits

37 States That Don t Tax Social Security Benefits Citybiz

15 States That Don t Tax Social Security Or Pensions

15 States That Don t Tax Social Security Or Pensions

T 37 T37 JapaneseClass jp