In this age of technology, in which screens are the norm but the value of tangible printed items hasn't gone away. Whether it's for educational purposes in creative or artistic projects, or just adding an extra personal touch to your area, Is There A Standard Deduction For Form 1041 have become a valuable source. Through this post, we'll dive through the vast world of "Is There A Standard Deduction For Form 1041," exploring their purpose, where to find them, and how they can add value to various aspects of your life.

Get Latest Is There A Standard Deduction For Form 1041 Below

Is There A Standard Deduction For Form 1041

Is There A Standard Deduction For Form 1041 -

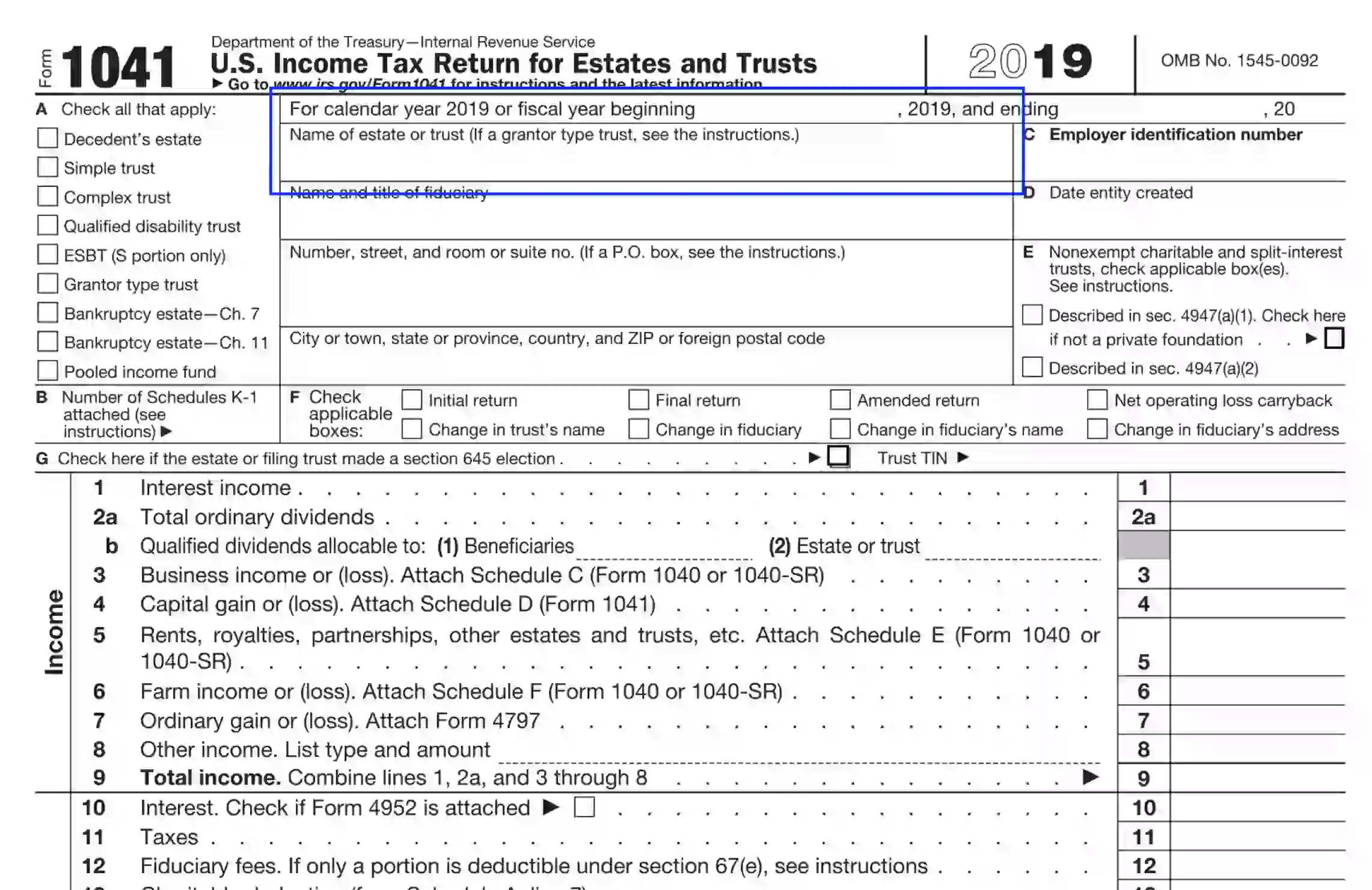

Certain deductions like the standard deduction are not available on Form 1041 Additional schedules like Schedule D Schedule I etc apply specially to 1041 So while 1041 handles some income aspects like 1040 estates and trusts have specific rules and rates to understand What is tax form 1041 for dummies

The fiduciary of a domestic decedent s estate trust or bankruptcy estate files Form 1041 to report The income deductions gains losses etc of the estate or trust The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries

Is There A Standard Deduction For Form 1041 encompass a wide variety of printable, downloadable material that is available online at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and more. The beauty of Is There A Standard Deduction For Form 1041 lies in their versatility and accessibility.

More of Is There A Standard Deduction For Form 1041

How To Calculate Taxes With Standard Deduction Dollar Keg

How To Calculate Taxes With Standard Deduction Dollar Keg

Just like with personal income taxes deductions reduce the taxable income of the estate or trust indirectly reducing the tax bill On Form 1041 you can claim deductions for expenses such as attorney accountant and return preparer fees fiduciary fees and itemized deductions

Here you will enter the appropriate deductions expenses of the entity The deductions reported in this section will reduce the taxable income that the entity will report on Form 1041 or the income that is available for distribution to the beneficiaries of the estate or trust

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor designs to suit your personal needs whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Printables for education that are free cater to learners of all ages, which makes them a great instrument for parents and teachers.

-

An easy way to access HTML0: Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Is There A Standard Deduction For Form 1041

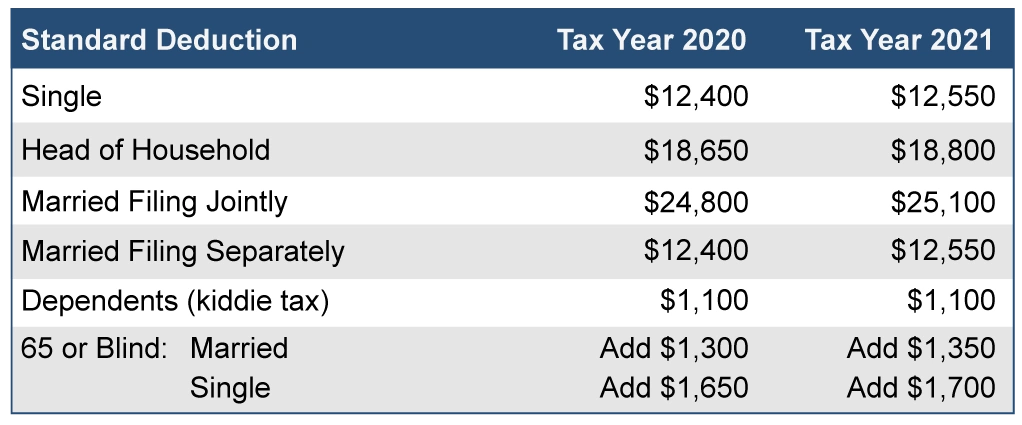

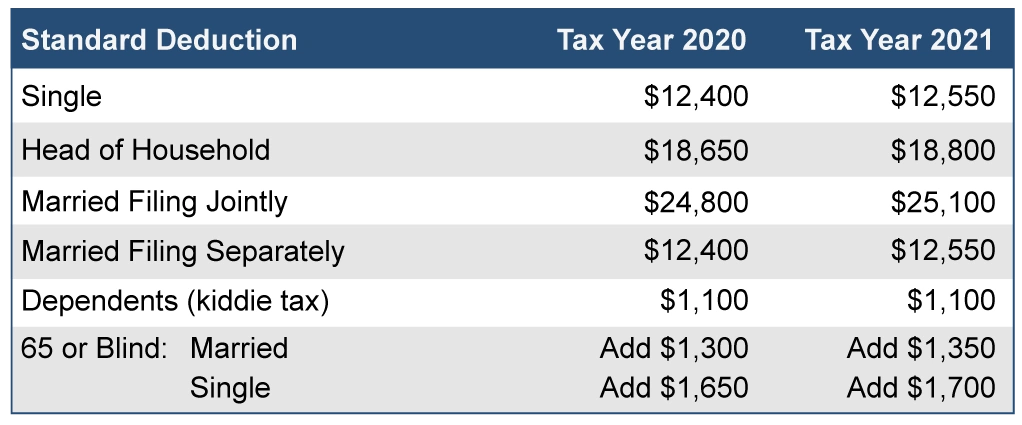

Standard Deduction Amounts For 2021 Tax Returns Don t Mess With Taxes

Standard Deduction Amounts For 2021 Tax Returns Don t Mess With Taxes

10 551 14 450 35 14 451 37 The standard rules apply to these four tax brackets So for example if a trust earns 10 000 in income during 2023 it would pay the following taxes 10 of 2 900 all earnings between 0 2 900 290 24 of 7 099 all earnings between 2 901 10 000 1 703 76 Total Taxes 1 993 76

Income and deductions are reported on the Form 1041 tax return Only income earned from the time of the decedent s death until bequests are made is reported on Form 1041 Form 1041 can be e filed for deaths that occur in

Since we've got your curiosity about Is There A Standard Deduction For Form 1041 and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Is There A Standard Deduction For Form 1041 for various reasons.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Is There A Standard Deduction For Form 1041

Here are some ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Is There A Standard Deduction For Form 1041 are a treasure trove filled with creative and practical information which cater to a wide range of needs and interest. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the many options of Is There A Standard Deduction For Form 1041 right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is There A Standard Deduction For Form 1041 truly free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printables to make commercial products?

- It's based on the terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to check the conditions and terms of use provided by the designer.

-

How do I print Is There A Standard Deduction For Form 1041?

- You can print them at home using the printer, or go to the local print shop for more high-quality prints.

-

What program do I need to run printables free of charge?

- The majority of PDF documents are provided in PDF format, which can be opened using free software, such as Adobe Reader.

Irs Form 1041 For 2023 Printable Forms Free Online

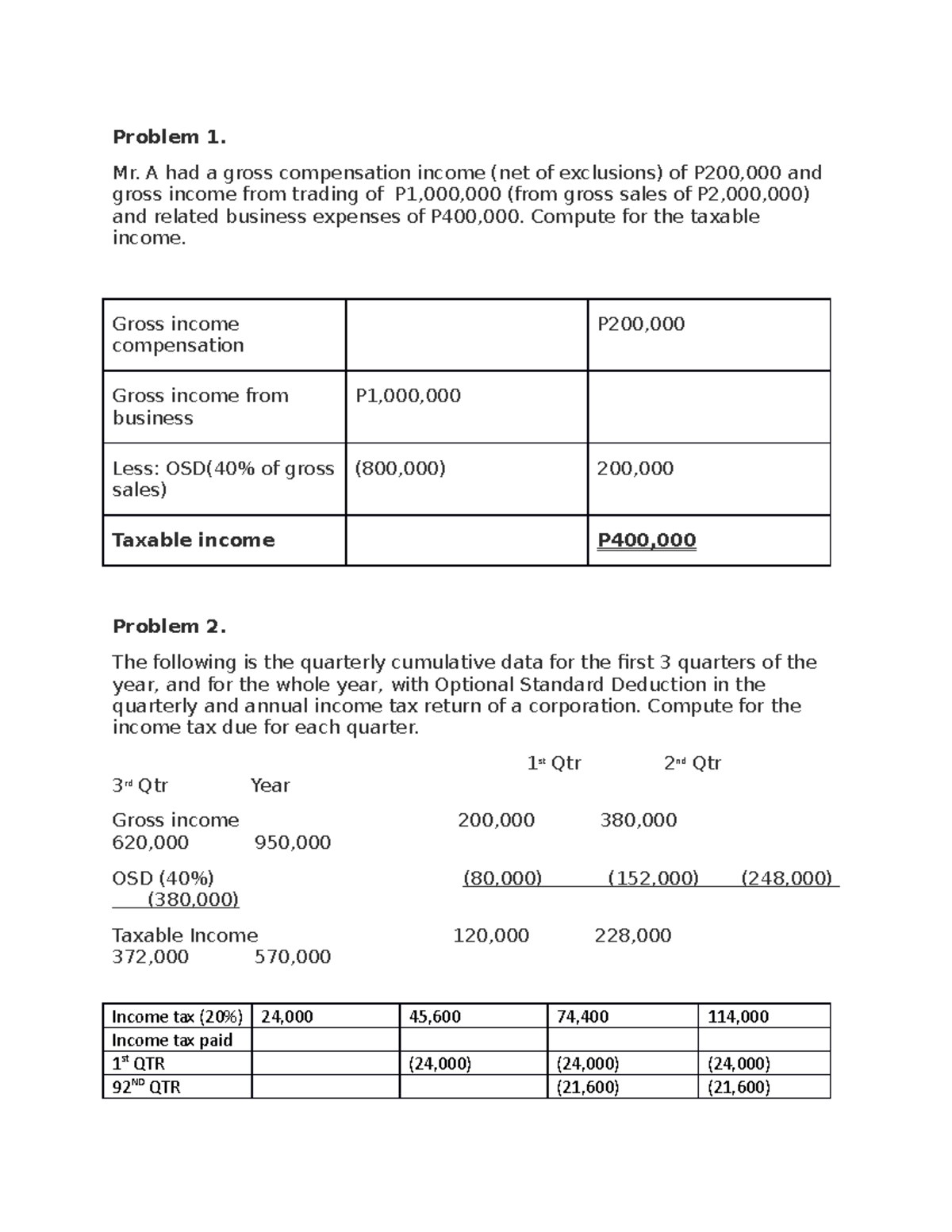

5 2 Exercise Optional Standard Deduction Problem 1 Mr A Had A

Check more sample of Is There A Standard Deduction For Form 1041 below

Itemized Vs Standard Tax Deductions Pros And Cons 2023

Disk U e Zvuk Schedule 1 Kuhinja Rezidencija Ekspertiza

Should You Take The Standard Deduction On Your 2021 2022 Taxes

2022 Federal Tax Brackets And Standard Deduction Printable Form

What Is The Standard Deduction For 2021

Tax Deductions You Can Deduct What Napkin Finance

https://www.irs.gov/forms-pubs/about-form-1041

The fiduciary of a domestic decedent s estate trust or bankruptcy estate files Form 1041 to report The income deductions gains losses etc of the estate or trust The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries

https://www.investopedia.com/tax-form-1041-estates-and-trusts-5211109

Part of Section 1041 of the Internal Revenue Code IRC Form 1041 is used to declare any taxable income that an estate or trust generated after the decedent passed away and before designated

The fiduciary of a domestic decedent s estate trust or bankruptcy estate files Form 1041 to report The income deductions gains losses etc of the estate or trust The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries

Part of Section 1041 of the Internal Revenue Code IRC Form 1041 is used to declare any taxable income that an estate or trust generated after the decedent passed away and before designated

2022 Federal Tax Brackets And Standard Deduction Printable Form

Disk U e Zvuk Schedule 1 Kuhinja Rezidencija Ekspertiza

What Is The Standard Deduction For 2021

Tax Deductions You Can Deduct What Napkin Finance

What Is The Standard Federal Tax Deduction Ericvisser

1040 Deductions 2016 2021 Tax Forms 1040 Printable

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Itemized Vs Standard Tax Deductions Pros And Cons 2023