In a world where screens dominate our lives and the appeal of physical printed materials isn't diminishing. Be it for educational use, creative projects, or simply to add a personal touch to your home, printables for free have become an invaluable source. Through this post, we'll dive into the sphere of "How Do You Calculate The Taxable Amount Of Social Security Benefits," exploring what they are, where to locate them, and how they can improve various aspects of your daily life.

Get Latest How Do You Calculate The Taxable Amount Of Social Security Benefits Below

How Do You Calculate The Taxable Amount Of Social Security Benefits

How Do You Calculate The Taxable Amount Of Social Security Benefits -

Help Frequently Asked Questions Social Security Income Top Frequently Asked Questions for Social Security Income I retired last year and started receiving social security payments Do I have to pay taxes on my social security benefits Are social security survivor benefits for children considered taxable income

You can calculate yours by adding up Your adjusted gross income AGI Your nontaxable interest Half of your annual Social Security benefits Your AGI is your annual income minus certain tax

How Do You Calculate The Taxable Amount Of Social Security Benefits provide a diverse collection of printable resources available online for download at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and much more. The appeal of printables for free is in their versatility and accessibility.

More of How Do You Calculate The Taxable Amount Of Social Security Benefits

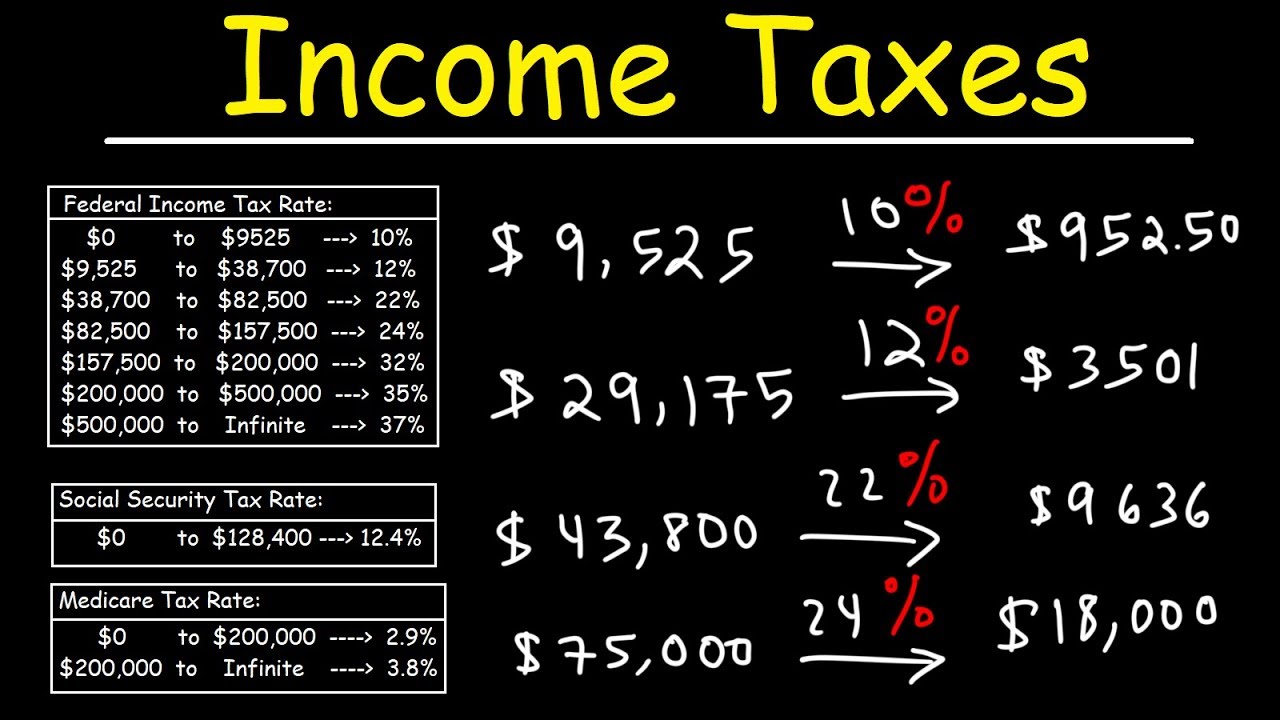

How To Calculate Federal Income Taxes Social Security Medicare

How To Calculate Federal Income Taxes Social Security Medicare

A The portion of income between 32 000 and 44 000 is taxed according to the pre 93 rules at 50 amounting to 6 000 of taxable social security 44 000 32 000 12 000 x 5 6 000 B The provisional income over 44 000 joint is taxed according to the post 93 rules at 85

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income includes pensions wages interest dividends and capital gains

How Do You Calculate The Taxable Amount Of Social Security Benefits have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization They can make the templates to meet your individual needs such as designing invitations making your schedule, or even decorating your house.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes the perfect device for teachers and parents.

-

Simple: Fast access a myriad of designs as well as templates will save you time and effort.

Where to Find more How Do You Calculate The Taxable Amount Of Social Security Benefits

Calculate Taxable Portion Of Social Security TaxableSocialSecurity

Calculate Taxable Portion Of Social Security TaxableSocialSecurity

Social Security benefit taxes are based on what the Social Security Administration SSA refers to as your combined income That consists of your adjusted gross income plus any nontaxable interest you earned and certain other items and

How Is Social Security Calculated 1 Calculate Your Monthly Earnings 2 Calculate Your PIA 3 Adjust Your PIA How Inflation Impacts Your PIA Social Security FAQs Photo The Balance Emilie Dunphy A complex formula determines how your Social Security benefits are calculated The following factors go into the formula How long

Since we've got your curiosity about How Do You Calculate The Taxable Amount Of Social Security Benefits and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of How Do You Calculate The Taxable Amount Of Social Security Benefits to suit a variety of reasons.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad range of interests, that includes DIY projects to planning a party.

Maximizing How Do You Calculate The Taxable Amount Of Social Security Benefits

Here are some new ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Do You Calculate The Taxable Amount Of Social Security Benefits are a treasure trove of creative and practical resources for a variety of needs and passions. Their availability and versatility make them an essential part of each day life. Explore the endless world that is How Do You Calculate The Taxable Amount Of Social Security Benefits today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printables to make commercial products?

- It depends on the specific usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright concerns when using How Do You Calculate The Taxable Amount Of Social Security Benefits?

- Certain printables could be restricted in use. Be sure to check the terms and conditions provided by the designer.

-

How do I print How Do You Calculate The Taxable Amount Of Social Security Benefits?

- Print them at home using a printer or visit any local print store for top quality prints.

-

What program is required to open printables at no cost?

- The majority of printables are in the PDF format, and is open with no cost software, such as Adobe Reader.

Resource Taxable Social Security Calculator

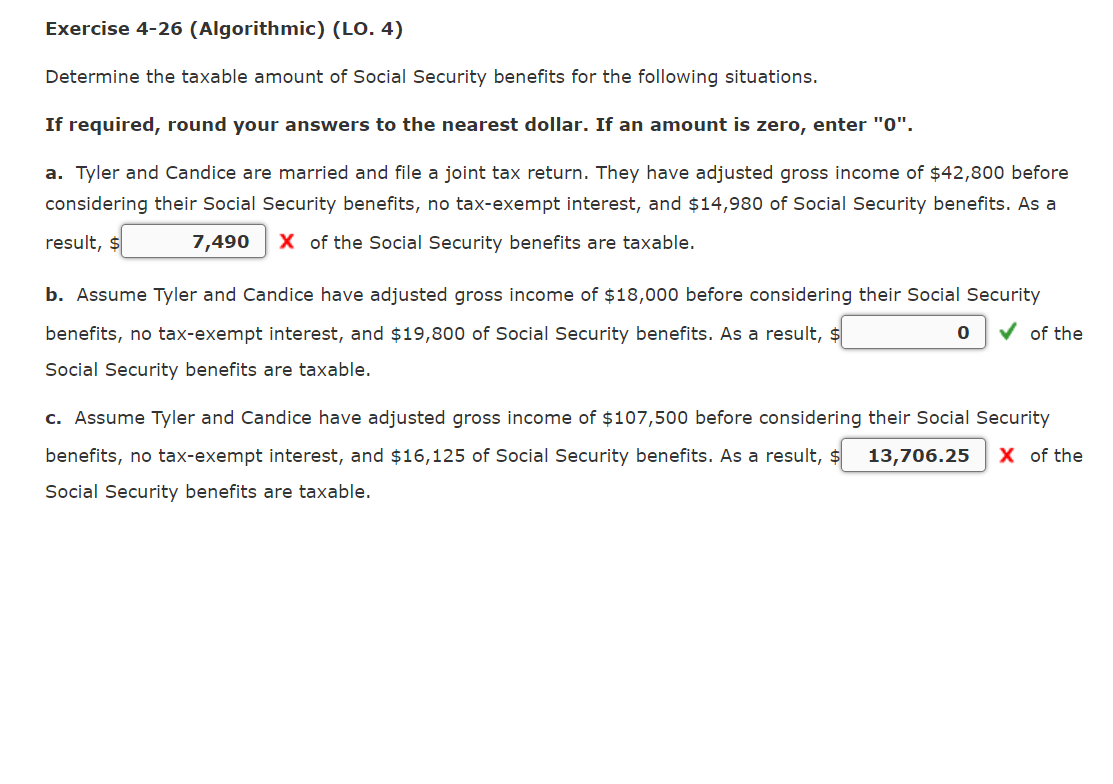

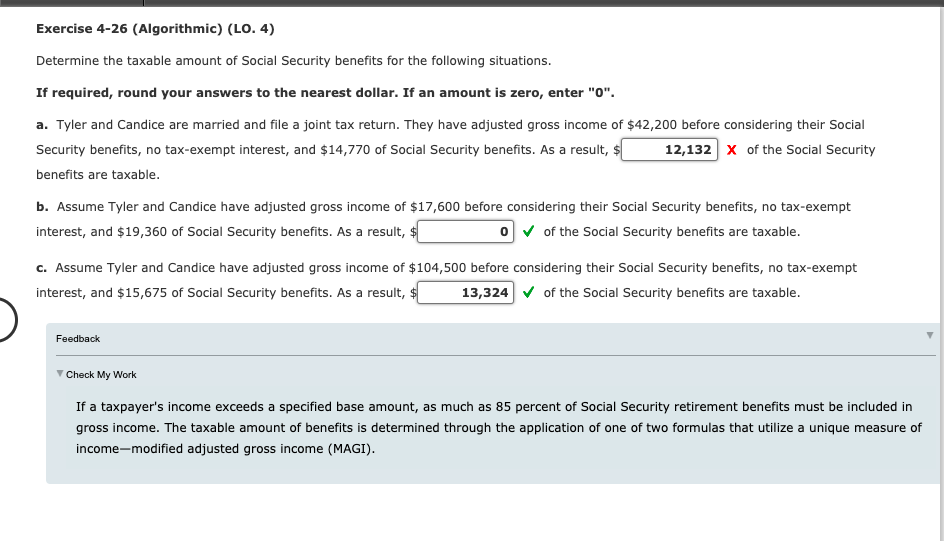

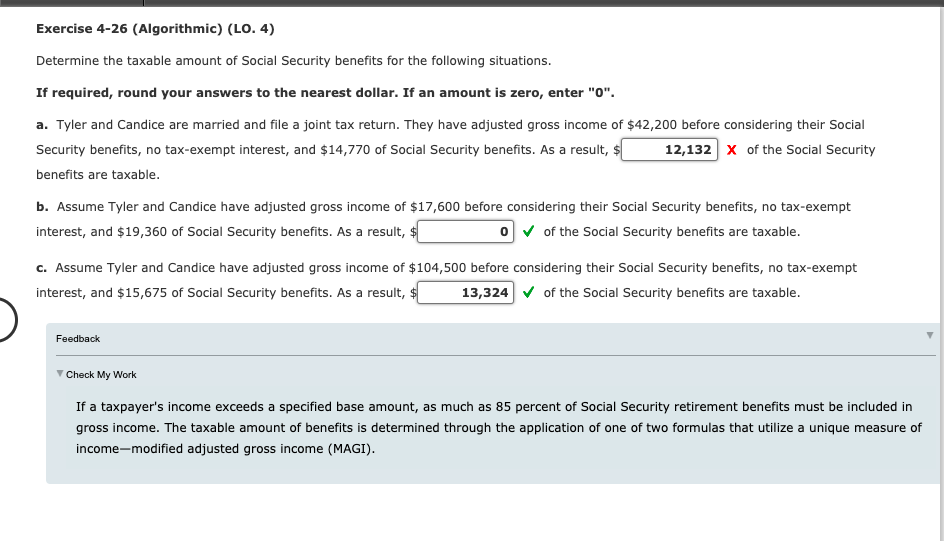

Solved Exercise 4 26 Algorithmic LO 4 Determine The Chegg

Check more sample of How Do You Calculate The Taxable Amount Of Social Security Benefits below

Taxable Social Security Calculator

Solved Exercise 4 26 Algorithmic LO 4 Determine The Chegg

Are My Social Security Benefits Taxable Calculator

What Is Taxable Income Explanation Importance Calculation Bizness

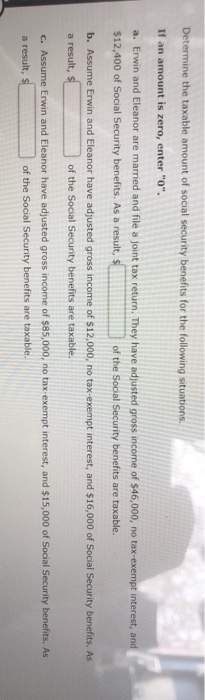

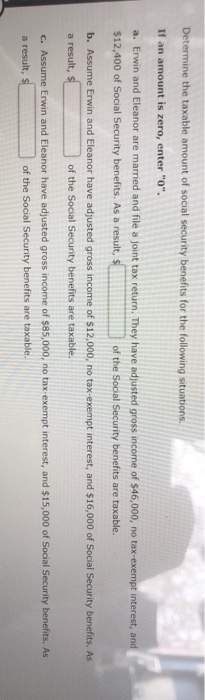

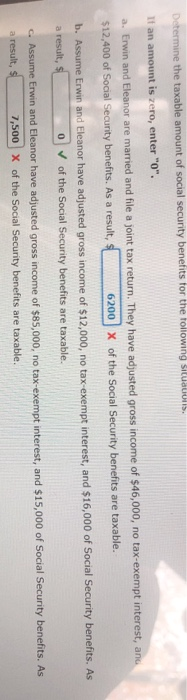

Solved Determine The Taxable Amount Of Social Security Chegg

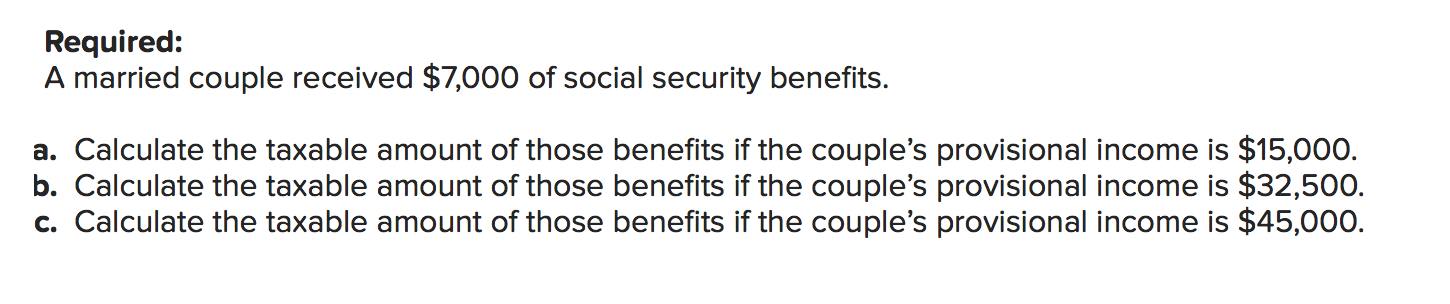

Solved Required A Married Couple Received 7 000 Of Social Chegg

https://www.fool.com/retirement/2019/12/15/how...

You can calculate yours by adding up Your adjusted gross income AGI Your nontaxable interest Half of your annual Social Security benefits Your AGI is your annual income minus certain tax

https://smartasset.com/retirement/is-social-security-income-taxable

Luckily this part is easy First find the total amount of your benefits This will be in box 3 of your Form SSA 1099 Then on Form 1040 you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b

You can calculate yours by adding up Your adjusted gross income AGI Your nontaxable interest Half of your annual Social Security benefits Your AGI is your annual income minus certain tax

Luckily this part is easy First find the total amount of your benefits This will be in box 3 of your Form SSA 1099 Then on Form 1040 you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b

What Is Taxable Income Explanation Importance Calculation Bizness

Solved Exercise 4 26 Algorithmic LO 4 Determine The Chegg

Solved Determine The Taxable Amount Of Social Security Chegg

Solved Required A Married Couple Received 7 000 Of Social Chegg

Solved Determine The Taxable Amount Of Social Security Chegg

How To Calculate Current Tax Haiper

How To Calculate Current Tax Haiper

JAL